Accessibility Quick Links

Insights

Our experts share key insights to help make the wealth strategies that matter most to you easier to understand, relevant and actionable.

3 tips to stay mentally sharp in retirement

Learn how you can maintain your highest level of mental acuity as you enter this next life stage.

3 tips to stay mentally sharp in retirement (PDF, 170 KB) Opens in a new window.

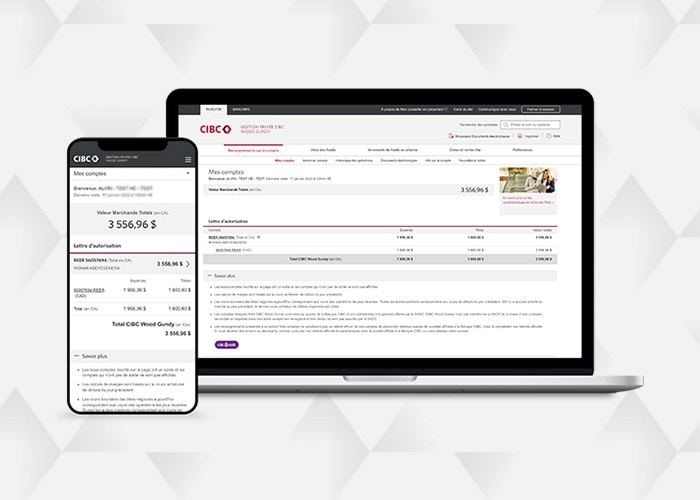

Take a tour of Wood Gundy Online

Discover how easy it is to keep track of your investment accounts, review exclusive research, analyst reports and explore a variety of tools, resources and features.

Eco tips for renovating your vacation home

HGTV’s Scott McGillivray shares tips for a greener getaway home.

5 ways to lessen the "sandwich generation" load

For those of the "sandwich generation," caring for both children and aging parents can be challenging. These 5 tips can help support you through even the most difficult of days.

5 ways to lessen the “sandwich generation” load (PDF, 140 KB) Opens in a new window.

CIBC Wood Gundy Giving Back Program

Making a meaningful difference is life changing. Create your own charitable fund to support the causes you care about and inspire change in the future.

Transform the way you bank