Accessibility Quick Links

Insights

Our experts share key insights to help make the wealth strategies that matter most to you easier to understand, relevant and actionable.

2024 federal budget

Learn how this year’s federal budget could affect you.

3 tips to stay mentally sharp in retirement

Learn how you can maintain your highest level of mental acuity as you enter this next life stage.

3 tips to stay mentally sharp in retirement (PDF, 170 KB) Opens in a new window.

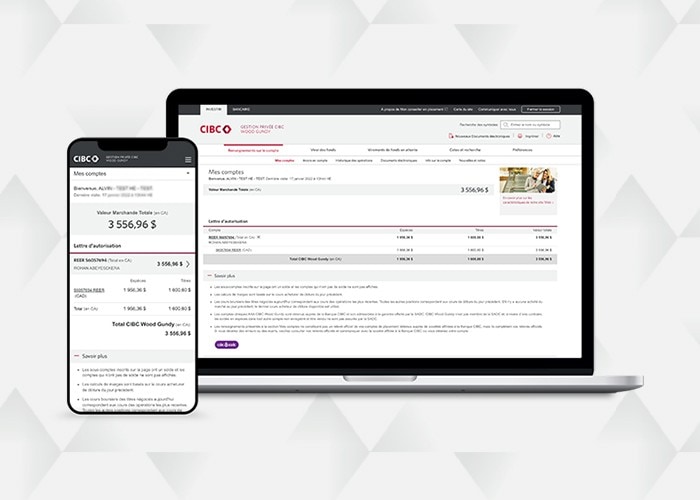

Take a tour of Wood Gundy Online

Discover how easy it is to keep track of your investment accounts, review exclusive research, analyst reports and explore a variety of tools, resources and features.

Eco tips for renovating your vacation home

HGTV’s Scott McGillivray shares tips for a greener getaway home.

5 ways to lessen the "sandwich generation" load

For those of the "sandwich generation," caring for both children and aging parents can be challenging. These 5 tips can help support you through even the most difficult of days.

5 ways to lessen the “sandwich generation” load (PDF, 140 KB) Opens in a new window.

CIBC Wood Gundy Giving Back Program

Making a meaningful difference is life changing. Create your own charitable fund to support the causes you care about and inspire change in the future.

Transform the way you bank