Haven’t made the switch to eDocuments?

Contact your advisor to register for Wood Gundy Online.

Insights

Our experts share key insights to help make the wealth strategies that matter most to you easier to understand, relevant and actionable.

2025 federal budget

Learn how this year’s federal budget could affect you.

Read article (PDF, 450 KB) 2025 federal budget. Opens a new window.

From heartbreak to handover: how a family business saved its legacy

Featured in The Globe and Mail: Explore real-life stories and expert advice to help you navigate the future of your business and legacy.

Read article From heartbreak to handover: how a family business saved its legacy.

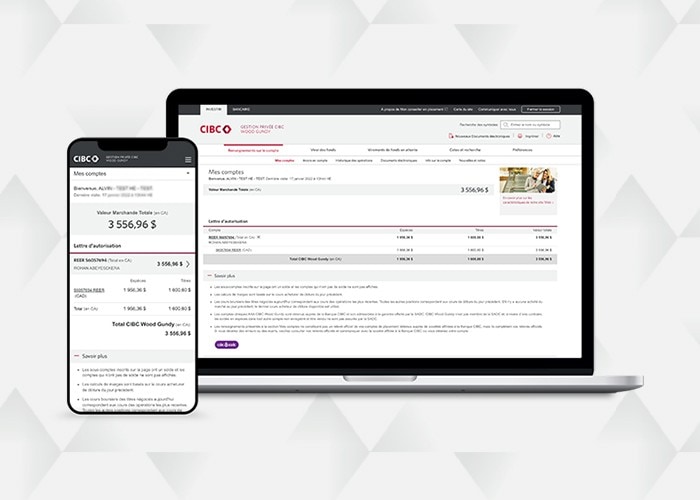

Take a tour of Wood Gundy Online

Discover how easy it is to keep track of your investment accounts, review exclusive research, analyst reports and explore a variety of tools, resources and features.

Start the conversation now to prepare your heirs for what’s coming

Featured in The Globe and Mail: Learn how early legacy planning discussions can ease stress and empower the next generation.

Read article Start the conversation now to prepare your heirs for what’s coming.

The sandwich generation squeeze is real — but you don’t have to go it alone

Featured in The Globe and Mail: Wealth planning and medical experts share experiences and insights to help caregivers find balance.

Read article The sandwich generation squeeze is real — but you don’t have to go it alone.

CIBC Wood Gundy Giving Back Program

Making a meaningful difference is life changing. Create your own charitable fund to support the causes you care about and inspire change in the future.

Learn more about the CIBC Wood Gundy Giving Back Program. Opens a new window.

Transform the way you bank